Table of Contents

Marginal Improvements Throughout Your Merchant Account

When it comes to preparing for an economic downturn and weathering the storm after it arrives, there’s never a foolproof solution to protect yourself. The traditional methods businesses choose are well-known – price increases, layoffs, slashes in marketing/advertising spending, and the list goes on. Although these solutions will work in the short term, they often have destructive effects on your business in the long term. In some cases, they’re the only options available, but exploring alternatives that could prevent, or at least delay, these drastic measures is crucial. If you’re planning for a slow quarter or economic downturn, we recommend looking at your business holistically. We can help you find the “hidden gems” of savings in your current program and provide insights on how to take advantage of them. Hidden gems are little efficiencies and cost-saving opportunities, and they add up quickly if you can find enough of them. You might be surprised at their impact on your bottom line.

We collaborated with Integrated Consulting Services, a team of fractional CFOs that are experts at providing financial peace of mind to small business owners, to uncover some of these hidden gems. The search for cost savings shouldn’t be limited to just your merchant account, however. Integrated Consulting Services offers a comprehensive review of your business and can build 12, 24, or 36-month plans to prepare your business for a sustainable future. You can check out the ICS process on their website if you’re interested in improving the efficiency of more than just your merchant account.

Integrated Payments

Integrations are vital for merchants to reduce the ‘soft costs’ in their payments. Soft costs are intangible and indirect costs associated with running a business. Integrations are important because they make things faster and easier. They streamline everything from manually keying in a credit card transaction to handling payroll and reconciliation. This will save your employees time to handle more critical revenue-generating tasks. It also removes the potential for human error that takes so much time to manually fix or repair.

There are three different types of payment integration systems:

- Your business is running transactions as non-integrated payments if your point-of-sale (POS) system doesn’t ‘talk’ to your payment processor through card readers. Non-integrated payments require your employees to manually input the dollar amount, confirm that the transaction was successful, and manually enter transaction data into your records. This is the most labor and time-intensive form of payment acceptance.

- The most convenient and efficient way to process transactions is with fully-integrated payments, also known as just ‘integrated payments.’ The entire payment process is automated, providing the best customer experience with the least amount of work for your employees. However, because fully-integrated payments are a hands-off process, you’ll need to double-check that your customer’s data is staying secure. Fully-integrated payments leave security in the hands of third-party software, so you’ll need to verify they have their security measures properly implemented.

- Somewhere between non-integrated and fully-integrated payments is a broad category called semi-integrated payments. Many merchants prefer semi-integrated payments because it’s a nice middle ground. You’ll save time and resources just like with a fully-integrated process, but you can also preserve some level of hands-on monitoring and customization to suit the needs of your business while also protecting your customers’ data.

Payment integrations might seem like an unnecessary luxury on the surface, but that’s the tricky part about handling the ‘indirects’ and ‘intangibles’ – they aren’t always easy to spot. Ultimately, choosing the right balance of integrations depends on your process and your industry. The only correct answer is that some are better than none, so reach out to your merchant services partner and see what they recommend.

Payment Card Industry (PCI) Compliance

PCI compliance, also known as the Payment Card Industry Data Security Standard, or PCI-DSS for short, is a standard that the major credit card brands established to protect the industry from hacks, breaches, and exposed customer data. Is your business PCI compliant? If not, you’re subject to penalties in the form of non-compliance fees. Even worse, you could expose your customers to hackers and be financially liable after a breach.

Becoming PCI compliant is easier than it sounds and is one of the best insurance policies you can get for your merchant account.

The Steps to Becoming PCI Compliant:

Find the Self-Assessment Questionnaire (SAQ) form that applies to your business. The SAQs differ slightly depending on how your business accepts credit cards, so it’s important to double-check that your business is eligible for the SAQ form you choose.

Complete the SAQ. It might seem overwhelming at first, but thankfully there’s a treasure trove of information online to help you complete the form. Additionally, you can use a merchant processing partner like Evolve Payment as a resource if you want more hands-on help.

Send the SAQ to your processor. Then, your processor will submit your finished form for approval. The turnaround time for this step is usually short. Once approval is confirmed, your processor will send your registration data to a PCI office. You should receive a certificate from them notifying you that you’re compliant!

Although finding the correct form and figuring out how to fill it out might seem daunting, a merchant services expert by your side will make every step frictionless and pain-free. We’ve helped our merchants from many different industry verticals with the PCI compliance process.

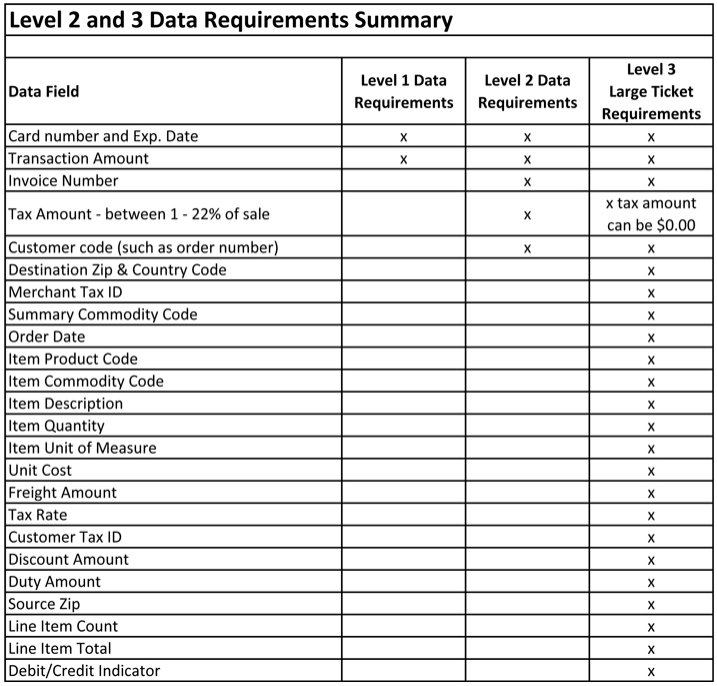

Qualifying for Level 2 & Level 3 Interchange Rates

Experienced merchant processing partners are an excellent resource for businesses accepting commercial cards like corporate cards and purchasing cards (p-cards). These forms of payments, along with other payment methods commonly used for B2B transactions, have the potential for big savings if managed correctly.

When you first opened your merchant account, chances are that your bank set you up with retail pricing, even if you don’t operate in a true retail environment. This means that you’re most likely passing Level 1 data with each transaction, even if you have the capabilities to provide more data and qualify for lower rates. Merchant service experts can set up B2B merchants with a system that passes Level 2 or even Level 3 data with each transaction. Passing more data will improve each payment’s security and qualifies your merchant account for a much lower interchange rate than what most B2B merchants are getting.

If your business handles a high volume of commercial credit card transactions, qualifying for Level 3 rates could shave 20%-40% off your monthly processing costs. When Evolve Payment partners with a merchant, we take a look at the data their system is passing with each transaction. We frequently save merchants thousands of dollars or more every year by focusing on interchange rates. The best part? The savings keep coming with little to no recurring work or upkeep!

Choosing the Right Merchant Processing Partner

For most merchants, merchant processing is a confusing industry. Many processors have purposely made it this way so they can hide fees (which we call ‘junk fees’) while reducing the number of questions coming in from their merchants. Unfortunately, merchant processing is unavoidable since your business can’t accept credit cards without a merchant account. Thankfully, merchant service providers like Evolve Payment are great resources to have while navigating merchant processing. If you’re looking for a new merchant processing partner, or want to review your relationship with your current partner, here are a few things to consider:

- Do they regularly evaluate your pricing program to make sure you’re maximizing your savings? Some partners go out of their way to regularly monitor your savings, while others will only do it if you tell them to.

- Can you pick up the phone and speak to someone locally, or will you be sent overseas to outsourced customer support?

- Do they force you to navigate an overly complicated automated online support process? Some merchant processing partners make you feel like they don’t want to talk to you.

- Are they transparent about your contract and the fees they charge you? Are any hidden costs snuck into your account after the contract was signed?

Merchant processing doesn’t have to seem like rocket science. With the right partner by your side, you’ll never have to worry about the details behind your payments. If you’re interested in learning more about why a merchant services partner is so important, give our team a call or request a free cost analysis. Our office is based in Minnesota, and we’re always ready to pick up the phone or meet you in person to discuss how we can elevate your merchant experience.