FAQ

Frequently Asked Questions and common merchant processing terms and abbreviations.

Find Answers to Merchant Processing Questions

Want a quick answer to a quick question? We’ve got you covered! Explore our growing list of FAQs about a wide range of merchant topics. Can’t find what you’re looking for? You can visit our blog, which has in-depth resources on everything from inflation to fraud and more! If you still can’t find your answer, send us a message with your question, and we’ll get back to you ASAP.

Why do you call yourselves "Merchant Advocates"?

Merchant processing can be a tough space to navigate. Technical terminology, pushy sales, and impersonal relationships give the industry a bad reputation and can send merchants into a whirlwind of headaches and unnecessary stress. Our mission is to change that by being more than just your merchant processor, but also an advocate that’s always in your corner. We fight for the best rates possible and will always give you personalized recommendations with only your best interests in mind. We’ll bring clarity to subjects like interchange and PCI compliance to surcharging, loyalty programs, and everything in between.

Payment processing is a lot less scary and overwhelming with a partner by your side that you trust. We want to be your full-service merchant processing partner by giving you solutions to everything your business needs – not just getting you low rates and disappearing. Let us prove it to you by giving us a call and saying hi! Our entire team is based in Minnesota and only a phone call away.

What is EMV?

Named after its original developers (Europay, MasterCard®, and Visa®), this technology features payment options (cards, mobile phones, etc.) with embedded microchips that store and protect cardholder data. EMV chip technology is becoming the global standard for credit card and debit card payments. This standard has many names worldwide and may also be referred to as chip and PIN or chip and signature.

What is PCI compliance?

PCI compliance, also known as the Payment Card Industry Data Security Standard, or PCI-DSS, is an important standard that major credit card companies like Visa and Mastercard have adopted to protect themselves and their merchants from the risks associated with exposed cardholder data. PCI-DSS is not the law; it’s a suggestion by the major card brands. However, much like the law, you’re subject to penalties in the form of non-compliance fees if you fail to become compliant.

You can learn more about the “why’s” and “how’s” behind PCI compliance in our blog about the topic.

Why does my business need to be PCI compliant?

The simple answer is for the protection of your business and your customers. Following the procedures and security measures outlined in the PCI compliance guidelines will protect the safety of your digital network reducing your liabilities in the event of a data breach. PCI DSS standards apply to businesses large and small and are required by all major credit card companies.

How can I store information for recurring billing?

Storing recurring payment transaction data must be done very carefully. The data must be encrypted, held on secure networks, workstations, and servers, have limited access by users and password and antivirus updates regularly. Visa® has more on PCI and Recurring Payments. Do you need to store data for recurring transactions? Check out AdaptrPay.

How much money can you save me?

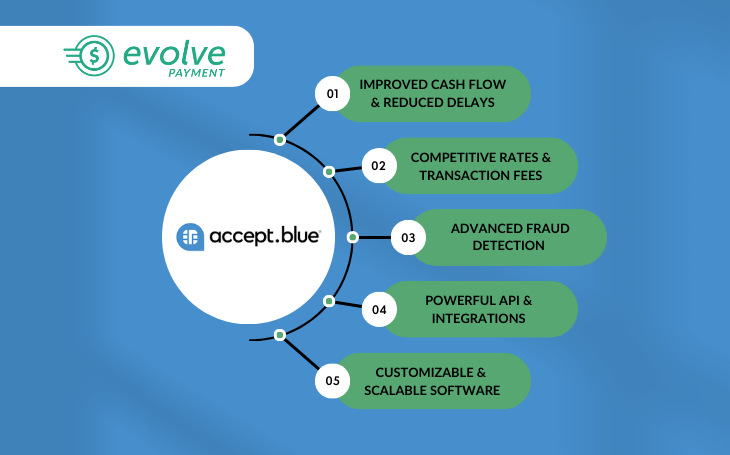

The amount of money we can save you depends on the volume you process, how you process the cards, and if you are a retail client or a B2B client. It is our goal to save a retail client over $50.00 each month, whenever possible. In B2B, we are special because we integrate with data sources and have the ability to save a significant amount of money by using a business consulting process. We provide an interchange management model that not only checks or downgrades fees but we also verify with over 600+ interchange categories to ensure your account is qualifying with the lowest interchange fees possible. Regardless, the merchant support and education services we provide you will save you time and headaches with benefits that go beyond your bottom line.

What are the fees associated with merchant processing?

Our merchant fees are all customized to meet the needs of our clients. We work directly with the pricing that is established by Visa®, MasterCard®, and Discover® called Interchange Plus, and we consider ourselves one of the most competitive ISOs in the industry because we write paperwork with multiple providers.

Should my business accept cryptocurrency payments?

There are many benefits associated with accepting crypto payments, although this will heavily depend on your business. Are you operating in a vertical with demand for crypto transactions? Are you operating an ecommerce store, brick & mortar, or both? Our team can provide you with all the information you need to make an educated decision based on the specifics of your business – just reach out. If you’d like a quick overview of crypto payments, you can check out our blog on the topic.

What is a merchant ID number?

A merchant ID number, also known as a MID, is a unique set of numbers that identifies your merchant account. Every merchant that accepts credit cards have one. Payment processors and banks use your MID to communicate with your merchant account while sending and receiving funds.

Can I write-off processing/transaction fees on my taxes?

The IRS recognizes merchant fees (commonly referred to as credit card fees) as an essential operating cost. So, that means that yes, businesses can claim the merchant processing fees they’ve accrued the previous year as a tax-deductible expense. However, there are special considerations and exceptions for merchants, so it’s important to do your research.

How are B2B payments and B2C payments different?

The foundational difference between B2B and B2C payments is the number of individuals involved in the transaction. Additional differences include payment size, payment frequency, payment terms, and payment methods.

Get the entire story in our detailed B2B vs. B2C resource guide.