Level 2 & Level 3 Processing

Qualify for Level 3 Credit Card

Processing Rates & Save Thousands

Commercial cards are expensive to process, and some merchants are left wondering how businesses can regularly accept them while protecting their bottom line. The truth is that not all B2B transactions are created equal. Whether you’re handling business credit cards, corporate cards, or p-cards for large purchase orders, there are opportunities for significant cost savings without impacting your payment experience. You can shave 20-40% off your monthly statement by working with industry experts like Evolve Payment to pass level 3 data with every transaction. This will permanently lower your rates, reduce the risk of your transactions, and lead to a healthy and optimized accounts receivable process that will pay dividends for years.

What Is Level 2 / Level 3 Payment Processing?

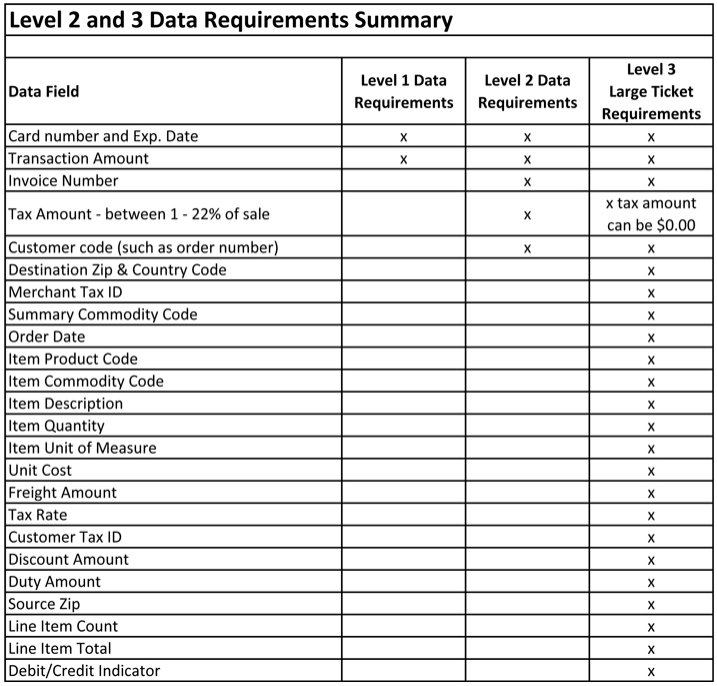

Your business is charged processing fees whenever your customer pays you with a card. One of these fees is called the interchange rate, which major card brands like Visa and Mastercard have implemented to cover the costs associated with fraudulent charges. The interchange rate varies based on a transaction’s risk – the more susceptible the payment is to chargebacks, the higher the interchange rate your business will pay.

You aren’t locked into these rates, however. The major card brands have created enhanced data programs for B2B (business-to-business), B2G (business-to-government), and G2G (government-to-government) transactions, rewarding merchants for passing additional data with their payments.

The more data you pass with each transaction, the more secure it is, and the lower your rates will be!

High Volume Processing at a Fraction of the Cost

How much money could your business save with level 3 rates? It’s common for our B2B merchants to see fee reductions of 30-40%, although the exact amount varies. Depending on your processing volume, this could equate to thousands of dollars or more in savings annually.

The best part is that these savings are passively accrued after the initial setup. Just get in touch with our team, tell us more about your business, and we’ll do the rest!

How do we set up your business with level 3 interchange rates?

Review A/R & Eligibility

We’ll review your accounts receivable process and help you answer questions about your current and future eligibility for a higher tier rate structure.

Install the Hardware

Based on the composition of payments your business accepts, we’ll provide you with the correct gateway and terminal capable of passing level 3 data.

Build the Framework

After the underlying infrastructure is in place, we’ll build your team a framework that makes it easy to provide the required data to achieve level 3 rates.

Find Out If Your Business Is Eligible for Level 3 Credit Card Processing

Although Level 3 processing is most applicable to B2B merchants that process large volumes in a card-not-present environment, this doesn’t necessarily mean you’re disqualified from achieving these rates. There are special cases that could apply to your business. Get a free cost analysis today to find out how much you can save.

Lower Your B2B Interchange Rates

With Evolve Payment

B2B companies from across the nation switch to Evolve Payment because we’re more than just a merchant processor. We’re your advocates that will stand up to the big players in payment processing and help you navigate the murky waters of the industry.

Our team takes a white-glove approach to solving your business problems. We don’t have a template we draw from when delivering a solution. Unlike some merchant processors that settle for ‘good enough,’ we take the time to look at your business holistically so we can bring the best solution to the table.

Our mission is to give you confidence when it comes to your payments. Evolve Payment’s merchant support team is always a phone call away. Give us a call or request a cost analysis online. We’re confident that you’ll make the switch and never look back.