In this article, we take a look at the accept.blue payment gateway while analyzing the key benefits of using accept.blue as a payment solution for your business. We also take a look at how Evolve Payment leveraged accept.blue’s powerful API to bring over one million dollars of cost savings to our client.

Keep reading to see the capabilities of accept.blue and how Evolve Payment can bring the same results to your business.

Table of Contents

Introducing the accept.blue Gateway

In today’s competitive market, businesses are constantly seeking ways to cut costs and improve their bottom line. One significant solution that has emerged is accept.blue, a company renowned for its innovative approaches to financial management and cost savings. Evolve Payment has successfully implemented accept.blue for numerous clients, and we’ve helped save them over one million dollars by capitalizing on this solution. However, saving money is not the only way Evolve Payment has helped our customers by leveraging accept.blue. We have also seen a significant return on time for many clients and the ability to extend our customers’ offering beyond just online payment acceptance.

Key Features & Benefits of accept.blue

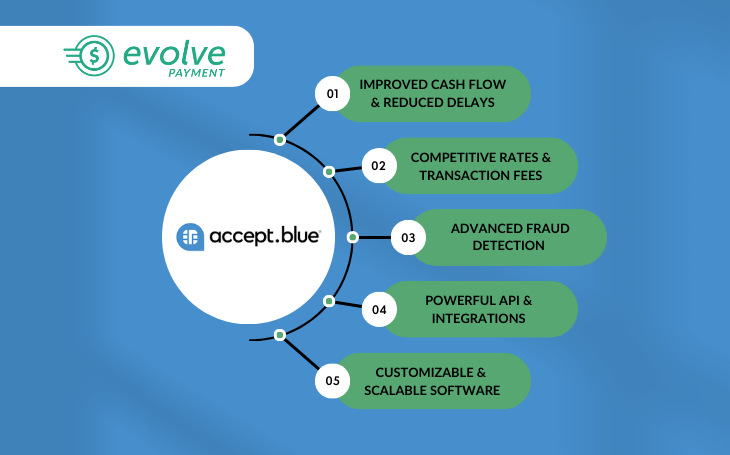

The accept.blue gateway is a revolutionary product in the payment processing space because of its customizability and robust catalog of features. The flexible API gives our team the freedom to build a solution that’s perfect for your business. Before exploring the use cases of accept.blue and an example of it in action, let’s first review some of the key features and benefits of the software:

- Streamlined Payment Processing: By offering efficient and fast payment processing solutions, accept.blue reduces the time clients spend on managing transactions. Faster processing speeds can lead to improved cash flow and reduced delays.

- Lower Transaction Fees: accept.blue offers competitive rates and lower transaction fees compared to other providers, so clients save money on each transaction. This is particularly beneficial for businesses with a high volume of transactions.

- Advanced Fraud Detection: Implementing advanced fraud detection tools helps in minimizing the risk of costly fraudulent transactions. This not only saves money but also the time and resources that would be spent on resolving these issues.

- Integration with Existing Systems: accept.blue provides easy integration with existing accounting systems, CRMs, ERPs, and billing software. It can save clients significant time and effort in reconciling and managing their financial data.

- Automated Reporting and Analytics: By offering automated reporting and analytics tools, clients can save time on manual report generation and gain valuable insights into their financials, aiding in quicker, data-driven decision-making.

- Customer Support and Training: Providing excellent customer support and training can significantly reduce clients’ time troubleshooting or learning how to use the system, thus allowing them to focus more on their core business activities.

- Scalable Solutions: accept.blue offers scalable solutions so clients can save money by only paying for what they need, with the ability to easily expand as their business grows.

- Customization Options: Customizable solutions mean that clients don’t have to spend additional resources on modifying the service to fit their specific business needs.

How accept.blue & Evolve Payment Helped a Regional Catering Company Save Millions

Evolve Payment’s customer, a regional catering company, shared that they were having difficulty in working with their B2B customers. They were asking for better, faster service with very large single transactions. Our client shared that providing a payment portal for their customers to use was critical to winning contracts with premier clients, and the “out of the box” solutions they had attempted to use had not provided the services they were looking for.

Evolve Payment, along with our sister company, Evolve Systems, used the accept.blue API and integrations to provide a solution that gives their customers, and their CFO, the tools they needed to win additional new business. The solution included the capability to pass level 3 data with each transaction, which slashed their credit card processing rates. Evolve Payment also added a complaint surcharging offering that contributed to the overall benefits to our client. These strategies combined have saved our client over a million dollars, directly to their bottom line. Combining this with the programming that Evolve is able to provide alongside our industry-leading support leads to a very happy customer who is a leader in their industry.

A Custom-Built Payment Gateway for Your Business

When it comes to assisting clients with saving money through innovative financial solutions, personalized service, and a commitment to leveraging the latest technology, accept.blue has proven itself as an industry innovator. Whether for small businesses or large corporations, its strategies and services are tailored to meet diverse needs, ensuring optimal financial health and efficiency. Embracing accept.blue’s approach can be a transformative step for any organization looking to enhance its financial operations and reduce costs.

Leverage accept.blue’s Robust API With Evolve Payment

The accept.blue API is well-built and comprehensive. The ability to seamlessly integrate with a wide range of different tools and products is a key benefit of accept.blue. Evolve Payment’s implementation team is experienced in maximizing the utility of accept.blue’s API to bring your business the custom-built payment solution it needs to save money and time. We’ve saved our clients millions of dollars and countless headaches by handling setup and support. Here’s how your business can capitalize on all of accept.blue’s features by partnering with Evolve Payment:

- Improved cash flow and reduced delays

- Reduced transaction costs

- Increased fraud protection

- Improved reconciliation and data management

- Valuable insights for better business decisions

- A payment solution that scales as your business grows

- A customized payment experience to fit your clients’ needs

Talk with our merchant expert

Book a time to chat with Don, our merchant expert, and learn how Evolve Payment can bring the benefits and cost savings of accept.blue to your business!